Consulting and Valuation in the World of Immuno-Oncology and Venture Capital

tfX-advisory was chosen as lead advisor for the E2E strategy development, including investor search and valuation, by a European based BioTech Start-Up. The company’s strategy applies a novel immuno-oncology approach, which is also the most promising method in the actual research for a break-through therapeutic treatment of COVID-19 (See Harvard note April 14th,2020). The client’s approach is engrained in an extensive and strategic portfolio of diagnostic and therapeutic patents.

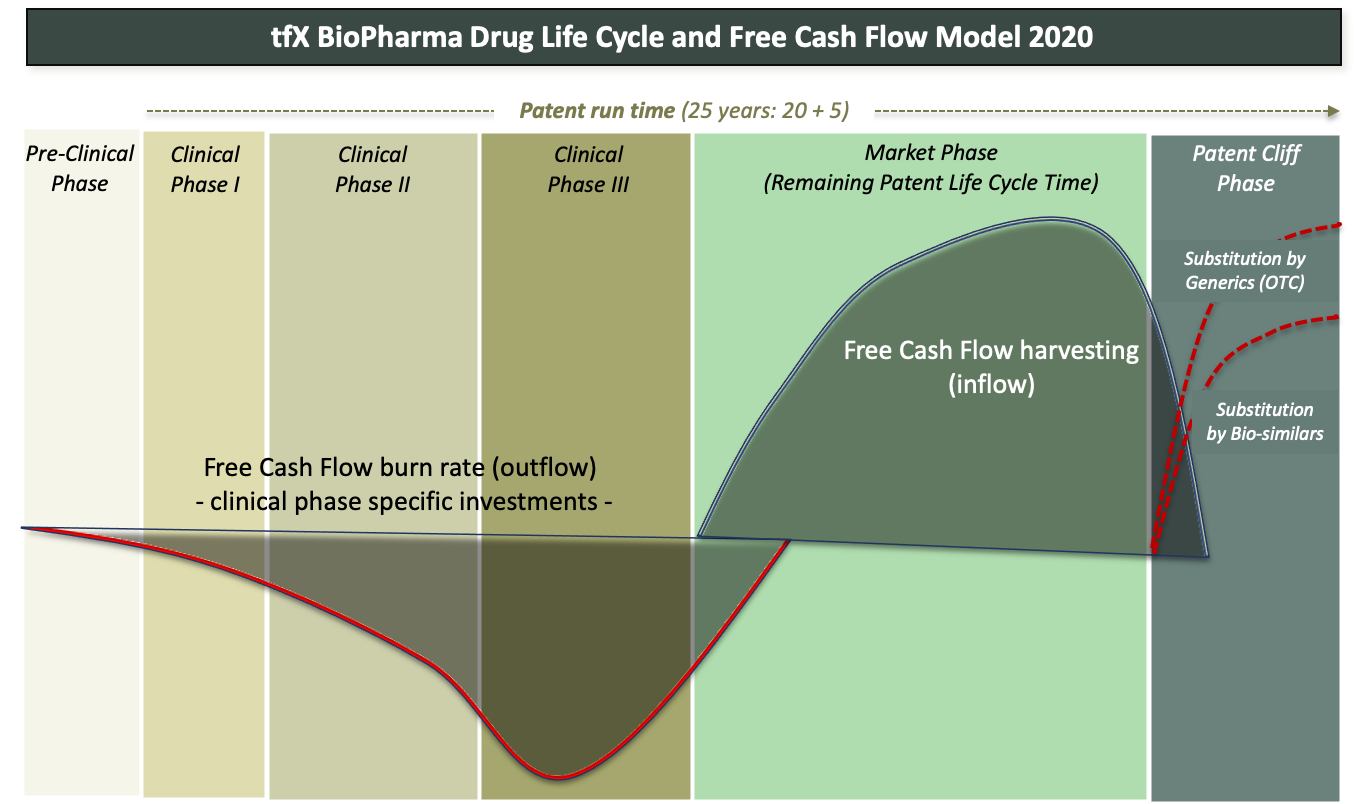

tfX-advisory applied, in a first step, the Real-Option advanced valuation model for this project to suit the typical BioPharma multi-stage (pre-clinical and clinical) setting. In a second step, the model was blended with a new tfX proprietary valuation approach to evaluate the robustness and resilience of innovative business designs. The latter will be released in the new, forthcoming book “An End-to-End M&A Process Design”, which will be available from June 2020 onwards.

The model is based on six value drivers, like the intensity of patent protection and the run time, IRR or market growth, which are unique for the BioPharma and BioTech ecosystem:

tfX-BioTech valuation approach and its six value drivers (2020) – more details will be released in summer 2020

Each driver is mission-critical for the Free Cash Flow pattern and therefore for any BioPharma company or patent valuation. The value drivers are based on in-depth research of leading global studies, expert interviews and further research for a plausible and back-tested valuation.

The overall project exemplifies once more the power of a true E2E strategy and M&A design, this time for the essential world of diagnostic and therapeutic BioPharma treatments.